georgia film tax credit history

Productions that qualify receive a 20 tax credit. Georgias Entertainment Industry Investment Act provides a 20 percent tax credit for companies that spend 500000 or more on production and.

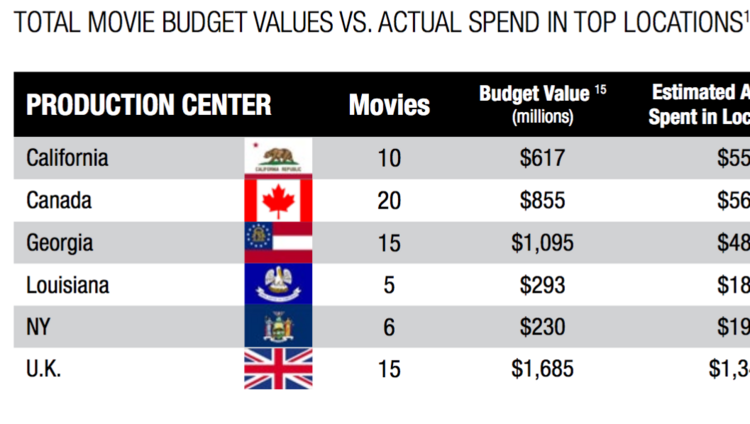

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Income Tax Credit Utilization Reports.

. The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified. Includes a promotional logo provided by the state. Statutorily Required Credit Report.

About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions. Income Tax Credit Policy Bulletins. 7-4026A effective January 1 2018 or the Musical Tax Credit codified in Code Section 48-7-4033 effective January 1 2018.

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Third Party Bulk Filers add Access to a Withholding Film Tax Account. An additional 10 credit can be obtained if the finished project.

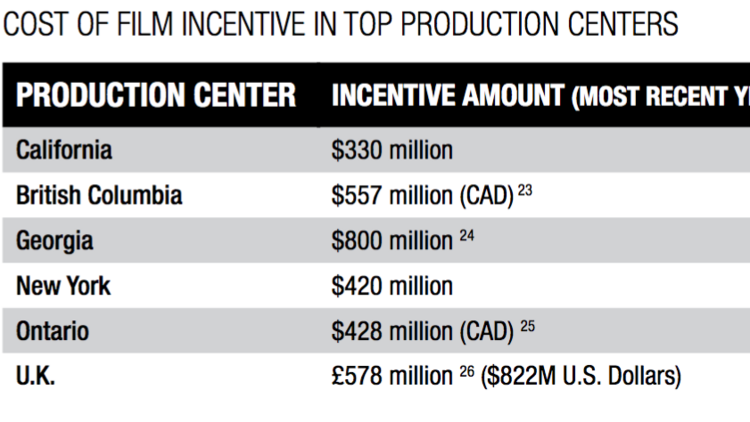

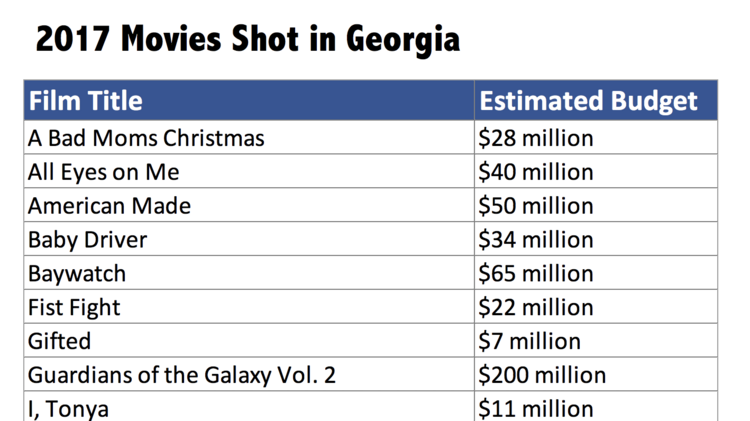

In 2016 more than 667 million in film tax credits were generated with the amount growing to more than 915 million in 2017. A 30 tax credit is in line with the most competitive of states. Certification for live action projects will be through the Georgia Film Office.

And music videos that are distributed outside of Georgia. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. How to File a Withholding Film Tax Return.

Before sharing sensitive or personal information make sure. The gov means its official. Tax The Georgia film credit can offset Georgia state income tax.

An additional 10 credit is given for placing a Georgia logo in your film title or credits. Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any other state. This audit evaluated the extent to which production companies that.

For services performed in Georgia. Speaker David Ralston and the bills sponsor state Rep. Television films pilots or series.

Many are unaware of this but Georgia is known as the Hollywood of the South because of all the film productions which choose the state as the location of choice. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages. Any qualified production expenditures claimed under the Postproduction Tax Credit or Musical Tax Credit are not eligible for the Film Tax Credit.

September 8 2020. With 33 billion invested in 2013 alone it is clear that the Georgia film business is booming now more than ever. Film Tax Credit Productions that cost more than 500000 are eligible for a 20 tax credit.

How-To Directions for Film Tax Credit Withholding. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. Local state and federal government websites often end in gov.

A Base Certification Application may be submitted within 90 days of the start of principal photography. The figure is 40 higher than the states previous record 860 million which was set in 2019 as the generous. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

The Georgia Department of Revenue GDOR offers a voluntary program. List of Film Tax Credit Expenditures Georgia Department of Revenue. The film tax credit is Georgias largest tax credit.

Georgia House Republicans unveiled a 1 billion tax cut package Tuesday on the same day their GOP colleagues approved the governors proposed 16 billion plan to send some of the states surplus revenues back to taxpayers. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule. The audit is requested through the Georgia Department of Revenue website GDOR and.

Georgias entertainment tax credit GEIIA passed in 2005 is already one of the most successful business incentive programs at the state level and a clear contributor to Georgias rise to stardom as a formidable competitor in. Highlights of the Georgia Film Tax Credit The Georgia Film Tax Credit as established by the 2005 Georgia Entertainment Investment Act allows up to a 30 tax credit. Projects first certified by DECD on or after 1121 with.

Register for a Withholding Film Tax Account. Income Tax Letter Rulings. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit.

An additional 10 credit can be obtianed if the finished product includes a promotional state-provided. Georgia Tax Center Information Tax Credit Forms. Claim Withholding reported on the G2-FP and the G2-FL.

The Georgia Department of. Free location scouting assistance is offered. Instructions for Production Companies.

Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. Of the film tax credit 18-03A was released earlier this month. The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to the subsequent tax year.

More than 3 billion in credits were generated from 2013-2017 with the amount increasing each year. Withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees. Important Changes to the Georgia Film Tax Credit.

Qualified Education Expense Tax Credit. 20 base transferable tax credit. Film television and digital entertainment tax credits of up to 30 percent create significant cost savings for companies producing feature films television series music videos and commercials as well as interactive games and animation.

In fact according to the Georgia Department of Economic Development there was a new record set last year with 399. A The Base Tax Credit means the 20 tax credit for productions that meet the. Some Georgia film tax incentives include.

Shaw Blackmon who chairs the Ways and Means Committee announced. FAQ for General Business Credits. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures.

The 500 of withholding would be eligible for a refund. Companies for services performed in Georgia when getting the Georgia Film Tax Credit. 6 Film Tax Credit means the tax credits allowed pursuant to the 2008 Georgia Entertainment Industry Investment Act OCGA.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Louisiana is generally considered to be the leader in film tax incentives offering an up to 35 tax incentive.

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Film And Tv S Tax Credits A State Guide To Competition The Hollywood Reporter

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Entertainment Industries Clg Wiki

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle